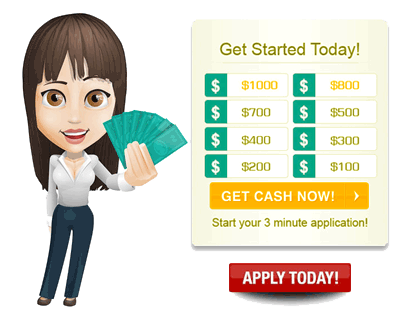

Loan Application is Just Few Clicks Away

Fast cash loans are short term loans of a low ticket size carrying a high rate of interest rate. Their primary customers are from the lower middle income segments of society. Such loans act as a medicine for all those who are in the middle of the month facing liquidity crisis with unavoidable expenditure on their heads. In general the loan size can range from $100 to $500 depending up on the earning and repayment capacity of the borrower. This amount can be utilized by the borrower to cover up the immediate financial crunch and complete the repayment by the next salary day.

Most of the lenders don’t attach a huge weightage to the credit score of an applicant; therefore it makes this loan as an attractive mode of borrowing money. However, each lender has a check list to which the customer needs to satisfy before even getting considered for such fast cash payday advance loans.

Fast track borrowing – Fast cash payday advance loans

Some of the items on that check list can be as follows:

Once the applicant satisfies all the points in the check list above, the application is further processed for a credit underwriting. At this stage, the lender undertakes the credit check for the applicant. The objective for such a credit check is to establish that the applicant is not in a bankruptcy status and is not a defaulting customer with any other financial institutions. These two are strong reasons of rejection of the applicant’s request for a fast cash advance loans.

On the loan approval, the lender shares the details of the amount sanctioned, applicable charges and fee involved and any other relevant information along with the repayment terms. It also provides the applicant with information on all the charges, penalties and interest which will be levied in case the applicant is unable to repay the loan. Applicant on agreement of all such conditions can request for the amount to be transferred to his bank account.

Once the payday loan is disbursed, the borrower is expected to clear out all the dues in a single balloon payment by or before the next pay date. If in any unforeseen situation where the borrower is facing problem in repayment by the promised date, he is expected to report it to the lender as soon as possible. The lender can then work out a possible solution to make the repayment easier for the borrower at this stage. The option of roll over of the loan to multiple months, repayment by the means of installments or other alternatives are provided to the borrower depending on his financial capability.

Although there are multiple options of borrowing money from the market, fast payday loans work with the USP of having the least turnaround time. While there are plenty of disadvantages of securing this type of credit, it serves to its name of providing an instant relief to a worrisome financial crisis of the borrower. Multiple states in the United States have made various regulations to govern this product and protect the interest of the customers. The applicants also should evaluate other alternatives like approaching a regular bank or looking forward to borrowing money from friends or instead of this loan using credit card etc. and do a thorough calculation before arriving at a decision to take up this product.