Loan Application is Just Few Clicks Away

When you run out of cash mid-month and can’t wait till the next payday, online Payday advance is your best bet to survive till the end of the month. You can obtain an online advance with no credit or even with bad credit. Online payday advance provides borrowers with quick money and without unnecessary bureaucracy; it’s an advance on your salary without essentially getting your boss’s approval. It gives you cash in times when you’re faced with an unanticipated bill, or need to take an emergency loan for things like car repairs or send some money to your sick mum. An online advance will sort you quickly. It covers you for three to four weeks, and it should be repaid on your next paycheck.

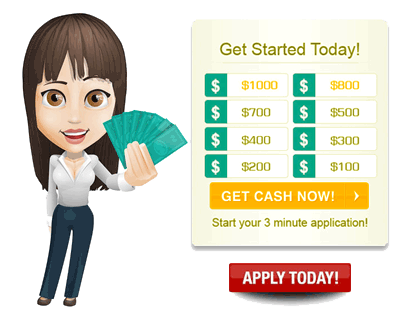

It’s hard enough trying to secure a single loan from the bank or alternative big lenders. These institutions demand unrealistic requirements and may keep you waiting for days on end in their complicated loan application procedure. Therefore, applying for an online payday advance is the best solution for you. Just submit your advance request online into a secure network of various direct lenders, ready to offer you amounts up to $1,000.

Go to the loan website of your choice, request a loan form, and key in your basic information including:

Once submitted, the lending system will send you a message to confirm your application. They will also confirm your borrowing status within minutes. Once your details match in the system, you shall be further advised of the loan disbursement details. You will be notified within minutes whether your payday advance has been approved or not. The lenders may also offer you a lesser amount than you had anticipated, and if you agree to their terms, you can go ahead and sign the loan agreement form.

Online Payday Advance No Credit Check Instant Approval

Having read the form and agreed to their terms of the loan offer, you may go ahead and sign the digital agreement. The lender does their due diligence by sending the loan advance into your checking account within 24 hours or so.

If your account reflects poor credit history – this should not worry or alarm you. Bad credit does not disqualify you from obtaining an online advance. Numerous borrowers in this situation have received loans through credible online lenders who appreciate that everyone deserves a chance at getting emergency loans when they need it the most.

Lenders will however require a history check of your bank account before lending you any cash. They may also check your employment history, your current wages, and your overall liquidity status. If a borrower can demonstrate his/her ability to repay the online advance on time, the lenders may consider approving your advance request. Your potential lender will need to settle on a reasonable loan amount to recommend you with appropriate paying terms. The payday advance should match your current financial position so that you can afford to pay back the loan without difficulty.

Interests will apply according to your borrowing needs and overdue repayment dates.